Cash Management Solutions

Here's how we can help.

Business Cash Management Service…coupled with the Incredible Customer ExperienceTM you’ve come to expect.

We’ve got the cash flow management tools that let you focus on your business, not your bank account. Tools like fraud protection, mobile banking, remote deposit capture, business credit cards, ACH, bill payments and merchant services all help you manage your funds. And if you need to talk to a real person, we’ve got a bunch of them ready to answer your questions.

What Cash Management services are you looking for?

All of these – I'd like to talk to someone.

Online Banking Tutorials IB Payroll by Fingercheck

Michigan

Wisconsin

Christopher Ashburn

VP Cash Management

Wausau

Phone: 715-348-1458

cashburn@incrediblebank.com

Titus Langlois

Cash Management Sales Officer Middleton

Phone: 608-203-9802

tlanglois@incrediblebank.com

Florida

What Cash Management questions do you have?

Your business may run on numbers, but we focus on the human connection to build real, lasting relationships with our business clients. We get to know you, your needs and how we can best provide assistance.

Cash Management FAQs

Below are some of the most common questions we hear about our Cash Management services:

Q: What is Business Cash Management?

A: Business Cash Management is the process of coordinating and optimizing your organization’s financial resources to ensure you have sufficient cash flow to operate. With the right Cash Management tools, your business can:

- Track, balance and forecast cash flow

- Manage payroll

- Send, receive and process payments securely

- Plan strategically for the future

Q: What is a wire transfer? How long does a wire transfer take?

A: A wire transfer is an electronic payment vehicle that allows your business to transfer money between bank accounts quickly and securely – even internationally. Wire transfers are a convenient tool if your business needs to make a large payment or send money to another country.

Domestic wire transfers can generally be completed within a business day, while international transfers may take 1-5 business days. Know that holidays, bank cut-off times, and intermediary banks can affect processing timelines.

Q: What is an ACH payment?

A: An Automated Clearing House (ACH) payment is a type of electronic funds transfer (EFT) method that enables your business to pay vendors, settle employee payroll (including direct deposit), reimburse employees, and more – made possible through the ACH nationwide network.

Q: What is Positive Pay?

A: Positive Pay is a fraud prevention service that serves as a security guard for your business’s cash flow. It protects you from check fraud and reduces the risk of unauthorized transactions going through.

More Business Banking Options For Your Business

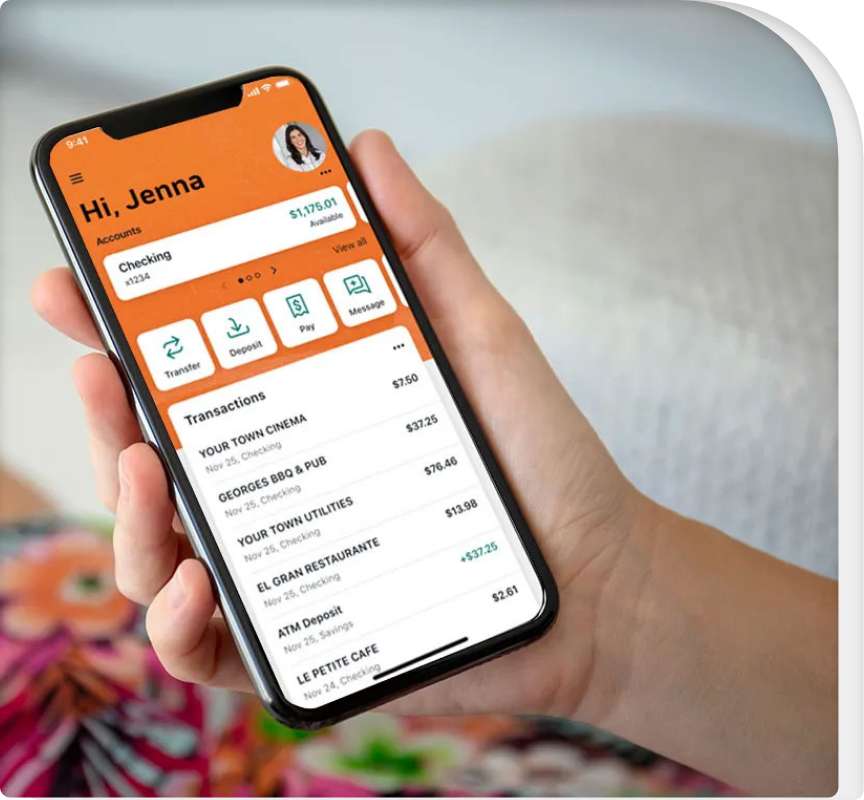

Mobile App

Business Checking

You need an account that gets the job done - so you can get your job done.